Impact of Terrorism and a Soft Economy on the Metro Denver and CO Tourist Industry

THE IMPACT OF TERRORISM AND A SOFT ECONOMY

on the

METROPOLITAN DENVER AND COLORADO TOURIST INDUSTRY

Prepared for the

Denver Metro Convention and Visitors Bureau

(http://www.denver.org)

by

The Adams Group, Inc.

Dr. Tucker Hart Adams, President

4822 Alteza Drive

Colorado Springs, CO 80917

303/329-9218

tuckhadams@aol.com

October 22, 2001

During the weeks of October 7 and 15, The Adams Group, Inc. conducted a mail and telephone survey of the membership of the Denver Metro Convention and Visitors Bureau (DMCVB) to determine the impact of the September 11 terrorist attacks and the economic downturn on the travel and tourist industry in metro Denver. Because the DMCVB has members outside of the metropolitan area, some of the survey results provide information on the impact across the state.

About 15% of the questionnaires (Appendix A) were returned, providing an interesting snapshot of the health of the metro Denver travel and tourist industry. The results are merely suggestive, not statistically valid, because of the method of selecting the sample that was interviewed. However, we believe it provides a fair representation of what is occurring in the industry.

The Situation

Across the nation, there are reports that the travel industry, already reeling from a weakening economy, was hard hit by the terrorist attacks. In the four weeks following the attacks, 1.9 million hotel rooms stood empty, up 46% from a year earlier. Orlando, the nation’s second largest hotel market, reported that the September occupancy rate fell to 45% from 62% a year earlier. In Washington, occupancy dropped 52% and in New York City the number of guests fell by 42%.

Airlines, already fighting a deep slump in business travel, slashed flight schedules by 20% and cut over 80,000 jobs in the US. By the end of September, air travel was still down by 30%. A national survey of corporate travel managers found that 88% expected their employees to travel less.

The Sample

The sample we surveyed covers a broad range of businesses operating in downtown and suburban Denver and a smaller group located in other parts of the state.

Hotels and attractions make up over half of the respondents. A variety of service businesses that focus on conventions and conferences comprise another 25% of the sample.

Transportation

A significant percentage of Denver’s business and leisure travelers arrive by air and Denver International Airport is the sixth busiest in the nation. The local tourist industry will be particularly hard hit by people’s unwillingness to fly in the wake of the terrorist attacks. Nationally, air passenger traffic declined 34.2% in September relative to a year earlier. Passenger boardings at Denver International Airport were down 25% in September, while the Colorado Springs Airport reported a 35% drop to its lowest monthly total in 6 1/2 years.

Survey participants reminded us that hot air balloon companies were unable to fly after the terrorist attacks because of restrictions on air space. Small planes that pull advertising banners over outdoor events were grounded.

Amtrak, on the other hand, reported a 17% increase in passengers the week after the attacks and ridership was up 12% relative to a year earlier in early October. The five-year annual average growth rate is only 2%.

Another important component of the transportation sector are the taxi, shuttle and limousine services that provide transportation to the airport and to gambling resorts in Black Hawk and Central City. In general, companies that provide transportation to Denver International Airport were hard hit, with ridership in the wake of the terrorist attacks dropping by 50%.

Transportation to gambling resorts felt little or no negative impact. In fact, one respondent even reported that ridership was up to the point that a price in increase would be implemented.

Attractions

Denver visitors spend 12.8% of their travel budget on entertainment, according to Dean Runyon Associates. A portion of this goes to local attractions such as tours and museums.

Seventy-two percentage of survey respondents reported that attraction attendance fell, while 16% reported an increase. Of those experiencing declines, most saw business fall off in the 10-20% range. Group tours, often focused on the elderly, had a higher level of cancellations.

Among those who reported attendance increased, several commented that gift shop sales were down 10-20%. Two respondents noted that although schools canceled visits in the week following the attack, they rescheduled later in the month. Another said locals who canceled travel plans visited nearby museums, so they felt little negative impacts. One speculated that after a few days, people needed to get away from their TVs and return to the simpler times of the Old West. Still another said they rely on weddings and school visits, which remained steady.

Lodging

Smith Travel Research reported that luxury and urban hotels were hardest hit in the wake of the terrorist attacks. The Starwood group of hotels (Sheraton, Westin, Four Points), for example, reported that 83% of September bookings were cancelled.

Closer to home, the Broadmoor Resort in Colorado Springs reported that 40 groups cancelled meetings and conferences following September 11 and estimated the cost of lost business at $8 million (Colorado Springs Gazette, September 20 and October 4, 2001). While some canceled meetings have been rescheduled, customers are reserving a smaller number of rooms. The Cheyenne Mountain Conference Center, also in Colorado Springs, estimated its loss at $2 million when its September occupancy rate fell to 33% rather than the expected 75%. A seasonal mountain resort reported it closed early after a 20% drop in visitors and revenues following the attacks.

Survey respondents reported a similar decline in occupancy. Over 57% said business was down from 5-50% and 5% said their occupancy rate was off over 50%. Denver hotels reported that troubled airlines were canceling rooms and demanding lower rates.

Bed and breakfasts and boutique hotels in metro Denver were especially hard hit, although they were honoring cancellations and returning deposits. One respondent said that within ten days of the terrorist attacks, all business scheduled through year-end had been canceled or rescheduled for spring.

Table 4: HotelOccupancy

The Rocky Mountain Lodging Report has documented a steady decline in hotel occupancy rates in 2001, with a nine-month year-to-date average of 66.5% relative to 71.6% in the first nine months of 2000. The occupancy rate metro-wide fell to 57.8% in September from 73.5% a year earlier. In downtown Denver, where conference and convention travelers are concentrated, the September occupancy rate plunged 17 percentage points, to 60.7%.

One large hotel that reported a substantial increase in revenues pointed out that it was well below earlier projections. Several hotels reported that advance bookings were down, as clients were hesitant to commit to programs normally planned well in advance. A mountain resort commented that although September business dropped off, the terrorist event occurred in an off-season and they are optimistic that bookings will recover by ski season.

Retail and Restaurants

Although the terrorist attacks came after Colorado’s important summer tourist season was over, the busy season for upscale restaurants frequented by the business traveler is mid-October through early March. Most restaurants reported that business was flat to down, although a few experienced a small increase in local business that helped offset loss of tourist revenues.

Retailers reported a 10-30% decline in revenues after September 11, accelerating a trend already underway. Some shopping centers reported they expect to see stores go out of business.

Conventions

In 2000, conferences generated $120 B in revenues in United States and September and October are peak months for business travel and conventions. The Economist reported that 60 international conferences were cancelled in September, including the annual meeting of World Bank and International Monetary Fund. Conferon expects convention attendance nationwide to be down 10% through year-end.

Five major national conventions were scheduled in Denver in October and November and, fortunately, none was cancelled. The National Recreation and Park Association expected 10,000 and reported attendance of 9,700. The American Association of Pharmaceutical Scientists, which expected 8,000, had 6,000 attend. The National Postal Forum, which normally has about 6,000 participants at its fall convention, had 3,400 . However, there were numerous reports of cancellations of smaller conferences and business meetings at hotels and meeting facilities, both along the Front Range and at mountain resorts.

Businesses that provide backroom support for conventions and business meetings were particularly hard hit. These include event and meeting planners, decorators, audiovisual and computer rentals and talent agencies. Some were already cutting staff as revenues plunged 20-30%. One commented that the phone had stopped ringing. Another that had experienced a number of cancellations was honoring contracts and providing full refunds, but is planning to add an Act of War clause to future contracts.

Direct marketers reported they were feeling the trickle down effect of the loss of convention business. Western entertainment venues saw business decline in the wake of fewer out-of-towners looking for a night of country western music and dancing. On a lighter note, a fishing resort said they were immune to the downturn, fishermen fish no matter what.

Gambling

The gaming industry in Colorado appears to be the least affected by the slowing economy and the terrorist attacks. Adjusted gross proceeds from gambling rose 11.8% in Gilpin County (Black Hawk and Central City) and 9.9% statewide in September, a somewhat slower pace than in previous years. Through August, revenues were up 7.l3% in Gilpin and 6.2% statewide.

The response to the survey from Colorado casinos was very limited. However, respondents reported an increase in business from in-state residents who canceled trips to Las Vegas, where hotel occupancy fell from over 90% to 50% following the terrorist attacks. Outside the state, riverboat gambling and Internet casinos said business held steady following September 11.

International Travel

International travelers are a relatively small component of Colorado tourism. According to the Travel Industry Association of America, Colorado received 7.8% of its travel spending in 1999 from international visitors. This is a segment that has been especially hard hit by the uncertainty generated by the terrorist attacks. For example, a quarter of the package tours booked to Hawaii, Guam and mainland America by a leading Japanese travel agency were cancelled following September 11. IATA forecasts that international air travel will be down 16% in the second half of year.

Only 1.6% of survey respondents plan to target the international market in their business promotions. One Denver firm that provides “adventure transportation” will reduce marketing efforts abroad and use advertising dollars to target domestic travelers..

Marketing Plans

When asked about their marketing plans, 89.5% of respondents said they plan to actively promote their business. Just over 8% said they had no marketing plans and 2.4% did not answer the question. The local market will be the primary focus, a target for 31.5%, with another 13.4% targeting the regional market (variously defined as the Front Range, Colorado and/or adjacent states). The leisure traveler will be a slightly more important focus than the corporate traveler, while 9.4% will actively promote the convention business.

Respondents plan to use a variety of approaches in their marketing campaigns. The print media is by far the most popular, chosen by 61.8%, followed by direct mail, 35.5%, and Internet/e-mail, 29.1%. Radio and the telephone were the only other two categories that will be used by more than 10% of respondents.

In general, there is a trend toward marketing closer to home. Those who normally market overseas will focus on the domestic market. Those who focus on the national market will emphasize the regional market. Those who market regionally will concentrate with in the state. Some said they would only market to tourists already in metro Denver to visit family and friends.

Benefit/Value Ratio

A potential strategy for dealing with a shrinking market is to cut prices or make other changes in the benefit/value ratio. Nationwide, hotels cut their average nightly room rate 15.4% through September. Many hotels offered 50% discounts. In Las Vegas, the Mandalay Bay, cut rates to $99 from upwards of $300, while the Stardust offered $48 rooms plus two free meals. Occupancy rates responded with a 12 percentage point increase.

Many Denver hotels are also dropping rates. The Rocky Mountain Lodging Report indicates that the average room rate in metro Denver hotels fell from $88.56 in September 2000 to $84.89 in September 2001, a 4.1% decline. In downtown Denver, it rose 2.9% to $124.73. In Colorado Springs, the Broadmoor slashed selected November/December rates by over 50% (Colorado Springs Gazette, 10/4/01). One commented, “We are trying to hold true to our rate. It’s not that the people who are traveling have become rate resistant; it’s that the travelers aren’t coming at all.” Another said they would maintain rates but increase value.

In total, over 31% of survey respondents said they are changing the benefit/value ratio, but, outside of the lodging industry, few plan to accomplish this by cutting prices. Although the survey did not address this question specifically, a common theme in the anecdotal responses was that businesses plan to maintain prices while increasing value by offering extra services. A group of vendors that serve the convention market said they were cooperating in an attempt to attract business by offering a package of services. Some retailers plan to hand out discount coupons to passersby.

Employment Impact

There were numerous reports of job losses following the terrorist attack, although many of these were already in the works in response to a soft economy. United furloughed 26% of its flight attendants, including 328 based in Denver, for three months beginning October 31. They also trimmed their flight schedule to 69% of the pre-September 11 level, suggesting more layoffs are in the works when this becomes effective November 1. Continental closed its Denver reservation office and layed off 74% of its local workforce of 1,280, a total of 950 jobs. The Hotel Employees and Restaurant Employees Union reported that one third of their members lost their jobs in the weeks following the attacks.

Some respondents reported they were using the downturn to upgrade their labor force. Good employees are readily available and willing to work for lower wages.

Revenue Impact

In total, 65.3% of respondents reported that revenues have declined as a result of the slowing economy and the terrorist attacks. Another 9.7% said revenues were up. The remaining 25% chose not to answer the revenue questions, but from comments they made we can assume that most experienced revenue declines. The experience of the survey respondents is consistent with the World Travel and Tourism Council’s estimate of a 10-20% drop in global travel industry revenues over the next 12 months.

A smaller subset of our sample answered more detail questions on revenues before and after the terrorist attacks. There were enough resp

All four categories reported declining revenues both before and after September 11. And, all experienced an acceleration in revenue contraction in the wake of the attacks. The retail data are affected by the presence of a number of high-end retailers who were feeling the effects of job layoffs, a rising unemployment rate and eroding consumer confidence, all of which slowed the purchase of luxury goods early in 2001. For the state as a whole, retail sales growth slowed to 4.2% through August relative to 11.7% in 2000.

The one sector where there was a consistent increase in retail sales post-September 11 was businesses with a high volume of Internet sales. However, the sample is too small to be more than suggestive of spending patterns.

A study done for the Colorado Tourism Office by Dean Runyan Associates in June of 2001 found that travel spending in metro Denver in 2000 was $2.97 billion, about 35% of the $8.3 billion spent statewide. Of this, $660 million was spent on lodging, $686 million on eating and drinking, $607 million on retail sales and $379 million on recreation. While it is dangerous to extrapolate from a relatively small sample to the metro area as a whole, it seems reasonable to apply the September year-to-date decline to the 2000 data to estimate the loss to the metro Denver travel industry in 2001.

This suggests a 6.9% loss, or $119 million, in three important sectors of the tourist industry that comprised 58% of Denver’s travel industry in 2000. It does not appear reasonable to assume double digit declines in retail sales for the travel industry as a whole despite the losses reported by the survey sample. A more reasonable 5% decline would add another $30 million to the metro-wide loss, for a total of $149 million or 6.4% for the 79% of the industry represented by these four sectors. If the entire $2.97 billion travel industry lost 6.4% of its revenues due to the national recession and the terrorist attacks, this would subtract $190 million from the metro Denver economy in 2001. And this is predicated on a baseline assumption of no growth from 2000 to 2001, when growth in fact averaged 14.4% in 2000 and 2.4% in 1999.

Conclusions

Other sectors of Colorado’s travel industry that were not covered in the survey also report problems as we move through the fall and into the winter tourist season. Hunting, critical to the economy of many small towns in western Colorado, is down 25% or more, in part due to a 100% increase in the cost of elk and deer licenses, but compounded by the factors hurting other segments of the travel industry. The ski industry reports that bookings are slow and there were numerous cancellations following September 11.

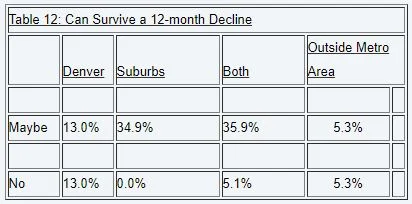

Businesses dependent on the Colorado travel industry are clearly worried about the impact of the recession and terrorist attacks on their long-term viability. When asked if they can survive an economic downturn in the travel industry that lasts 12 months, 4.8% said no and 26.6% were not sure. Among those respondents, those whose business was limited to downtown Denver were most pessimistic, while those doing business in the suburbs were most likely to say maybe.

While the estimate of a $190 million loss to the Denver economy because of a slumping travel industry has a large margin for error, it is not unreasonable. A 6.4% decline statewide would reduce travel spending in the state from $8.34 billion in 2000 to $7.81 billion in 2001, a loss of $530 million. If employment and tax revenues fall by the same 6.4%, this means the loss of almost 10,000 jobs and $37 million in state and local taxes, based on the Runyon estimates of 147,900 travel jobs and $577 million in total taxes attributable to the industry in 2000.